The Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, has called on banks and other financial institutions in the country to boost lending to young innovators and Small and Medium Enterprises (SMEs) to enable the nation achieve inclusive economic growth.

Edun, who made the call while speaking at the 2025 Fellowship Investiture of the Chartered Institute of Bankers of Nigeria (CIBN) in Lagos, on Saturday, said that although the banking industry was doing well amid the country’s accelerating economic growth, bankers need to do more for the growth to be inclusive.

He said: “We have come a long way, but … there are 400,000 graduates every year. We now have, what I would say is Mr. President’s agenda, rapid growth. It’s accelerating above 4%, well above 4%, and we look for it to continue. We have sustained the reforms since May 29, 2023. We have stayed the course; but we need inclusivity. That inclusivity means good-paying jobs for our young people.”

The Finance Minister noted that while reforms introduced by the current leadership of the Central Bank of Nigeria (CBN) has ensured that there is now a level playing field with regard to access to foreign exchange, more effort is required to enable young innovators and SMEs to access credit.

As he put it: “We, the finance industry, the banking industry, we have more work to do because we must finance the ideas. We must deepen our markets, the capital market, the banking credit market, right down to small SMEs. They should not have to go to Silicon Valley.”

Edun commended the apex bank, under the leadership of its Governor, Mr. Yemi Cardoso, for maintaining monetary discipline, describing the tight policy stance as a necessary step to curb inflation and stabilise the financial system.

“We all know that monetary policy under Cardoso has stabilised the financial system in a most commendable way. Of course, it is a team effort, and those eye-watering interest rates have to be paid by the fiscal side. But the fight against inflation is one we all have to participate in,” he said.

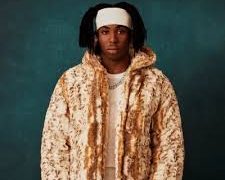

The Minister, who was among 22 prominent personalities, including CBN Deputy Governors in charge of Economic Policy, Corporate Services and Operations Directorate, Dr. Mohamed Abdullahi, Ms. Emem Usoro, Dr. Bala Bello, respectively, invested as distinguished Honorary Fellows of the CIBN, at the ceremony, thanked the Institute for the honour.

In his speech, Governor of Lagos State, Mr. Babajide Sanwo-Olu, who was represented by his Commissioner of Finance, Mr. Abayomi Oluyomi, thanked the CIBN for hosting the ceremony in Lagos. He pledged that the state will continue to partner with the Institute as it strives to promote the values of integrity and ethical conduct within the Nigerian banking and finance industry.

The President/Chairman of Council of the CIBN, Professor Pius Olanrewaju, in his keynote address, described the theme of the event, “Banking Beyond Boundaries: Leveraging Technological Innovations for Enhanced Performance in the Nigerian Banking Industry,” as both timely and inspiring.

According to him, the theme captures the profession’s evolution, “from physical operations to boundless digital innovation that continues to evolve.”

He noted that: “Over the past decade, Nigerian banks have evolved into expansive digital ecosystems, enabling real-time connections among millions of individuals and enterprises. Electronic payment transactions rose to N384 trillion in July 2025, with mobile and PoS payments surging over 200% year-on-year, driving financial inclusion and operational efficiency.

“The ongoing bank consolidation has strengthened sector resilience, with several banks meeting new capital requirements ahead of the 2026 deadline, boosting investor confidence and innovation.

“Importantly, Nigeria’s exit from the FATF grey list a few days ago marks a major milestone, restoring international confidence, easing trade and investment flows, and reinforcing the country’s commitment to transparency and financial integrity. Together, these developments position the Nigerian banking and finance sector as a vital engine for sustainable economic growth and regional leadership.”